The Prime Minister’s Youth Loan Scheme has been expanded to provide more opportunities for young Pakistanis. This new initiative is designed to help eligible students purchase laptops for educational purposes and offer financial support to individuals planning to work abroad. The State Bank of Pakistan (SBP) announced that the new loans will benefit individuals aged between 18 and 30 years from HEC-recognized institutions, as well as those who wish to pursue employment overseas.

Loans for Laptop Purchases

Under the expanded scheme, students from approved institutions can apply for loans to buy laptops. These loans will allow young people to enhance their learning and productivity by providing them with essential tools. Students will have the flexibility to choose a loan amount based on the laptop they wish to purchase, with a repayment period of four years, structured according to their university fee payment schedules. The interest rate will be set at KIBOR plus 3%.

| Laptop Type | Loan Amount (PKR) |

| Basic Model | 150,000 |

| Mid-Range Model | 300,000 |

| Advanced Model | 450,000 |

The loan amounts vary based on the type of laptop a student needs. The repayment terms will be customized to suit the university fee structure.

Loans for Overseas Employment

In addition to the laptop loans, this scheme also supports individuals seeking work abroad. Loans up to PKR 1 million will be provided to cover expenses like training, visa processing, and travel. These loans are available for individuals aged 21 to 45 years. With a five-year repayment plan, the loan will be offered at an interest rate of KIBOR plus 3%.

Also Read: Chief Minister Laptop Scheme 2025: What Happens if I Miss the Registration Deadline

Eligibility Criteria

To apply for the laptop loan, students must:

- Be between 18 and 30 years old

- Be enrolled in a recognized institution by the Higher Education Commission (HEC)

For the overseas employment loan, applicants should:

- Be between 21 and 45 years old

- Have a valid job offer from an overseas employer

These requirements ensure that the loans are offered to individuals who meet specific educational or employment criteria.

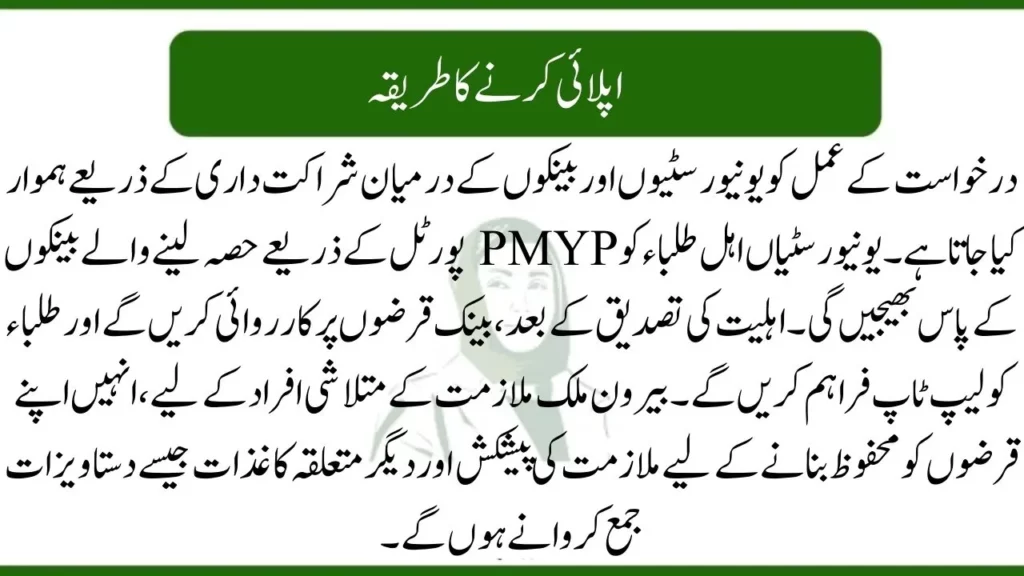

How to Apply

The application process is streamlined through partnerships between universities and banks. Universities will refer eligible students to participating banks via the PMYP portal. After eligibility verification, the banks will process the loans and provide the laptops to students. For those seeking overseas employment, they must submit documents like job offers and other relevant paperwork to secure their loans.

Conclusion

The expansion of the Prime Minister’s Youth Loan Scheme is a great initiative to support young people in Pakistan. By offering loans for laptops and overseas employment, the government is enabling the youth to access better educational tools and opportunities abroad. This will help them become more productive and contribute to the country’s growth in various sectors.

Also Read: Budget Allocation for the 2025 CM Punjab Laptop Scheme

FAQs

Can I apply for both loans?

Yes, you can apply for both loans if you meet the eligibility criteria for each.

How can I apply for the laptop loan?

You will be referred to participating banks through your university, which will verify your eligibility for the loan.

What is required to apply for the overseas employment loan?

You must provide a valid job offer or recruitment details verified by overseas employment promoters or relevant authorities.

Is there any collateral needed for these loans?

For the laptop loan, a personal guarantee may be required from a family member, while for the overseas employment loan, the loan can be jointly booked with a family member residing in Pakistan.